VAT Returns Xero – Flat rate scheme

To join the flat rate scheme your turnover must be £150,000 or less (excluding VAT), and you must apply to HMRC. With this scheme you pay HMRC a fixed rate of VAT, based on your sales, and do not claim back VAT on your individual purchases. The rate you pay depends on your business activity and is a rate you agree with HMRC.

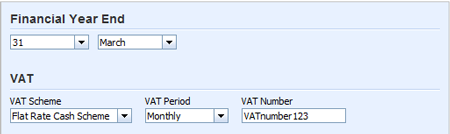

You must ensure the settings are correctly set up in Xero, so it knows that you’re using the flat rate scheme. To do this go to Settings>General Settings>Financial Settings

Accounting for VAT using the flat rate scheme

Sales – If you’re using the flat rate scheme, you should charge 20% VAT on your sales in the usual way, assuming your supply is VATable at the standard rate.

Purchases – Record all your purchases as No VAT.

Completing a VAT return

Perform the following steps to complete a VAT return:

1. Select Reports>VAT Return

2. Ensure the correct period is selected

3. Enter the flat rate percentage which applies to your business

4. Check the ‘Include VAT Late Claims’ box to include late claims on the return, provided you have published your previous period’s return.

5. Click Update to generate the VAT report

6. Click the VAT Audit Report tab to see all the transactions making up totals on the VAT Return. Scan down the list to make sure the sales and purchase in the return all look as you’re expecting, with the correct rates of VAT assigned. You may wish to ask your adviser to do this sense check for you.

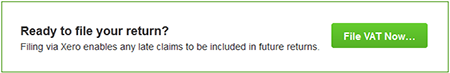

7. Click the File VAT Now… button at the bottom of your VAT Return.

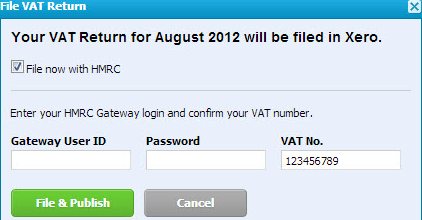

8. Confirm the VAT No. you are using is correct, enter your Gateway User ID and password, and click the File & Publish button on the File VAT Return screen.

10. Check the status of your filed VAT return with HMRC. Go to Reports>All Reports. Xero displays filed returns under the Filed with HMRC tab and shows the return as Pending. This is because it has been sent to HMRC but they haven’t processed it yet. Once HMRC has processed your return its status will change to Filed or Failed. If your status is Failed, click on the VAT Return link to read the error message, or read the notification in your Xero inbox.

9. The ‘flat rate adjustment to balance the vat account’ which appears at the very bottom of the Return is the difference between the standard VAT used on invoices or bills and the VAT amount claimed based on your flat rate percentage. The difference (usually a saving), will need to be journalled to the appropriate account by someone with the Adviser user role.

Go back to Xero Guidance home page.