National minimum wage rise for under 25s

National Minimum Wage – How it can affect your business

With the introduction of the National Living Wage in April 2016 for workers aged 25 and over, calls from the Low Pay Commission (LPC) for the Government to reevaluate the pay rates for the minimum wage were also high on the agenda.

With the acceptance of the LPC’s recommendations, the Government has now introduced a new National Minimum Wage (NMW). From October 1st 2016, an increase in the minimum wage will see a rise for all workers under 25, and apprentices that could have implications for employers.

However, as the NMW has not been widely publicised, you could be forgiven for missing the importance of this small, but significant change in pay. So, now is the time to ensure all pay rates for under 25 employees are updated and correct.

Rates on the rise

One of the key reasons for the NMW was the status of 21 – 24 year olds. Because of the introduction of the National Living Wage, this age range effectively became a new bracket within the minimum wage (the previous adult rate that applied to adult workers 21 and over, now only affects these workers).

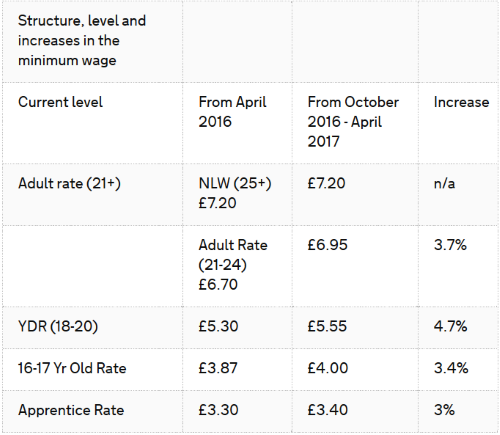

To keep in line with the Living Wage, the NMW rate sees a rise of 3.7% jumping from £6.70 to £6.95 per hour. Similar percentage hikes have also seen the Apprentice rate rise to £3.40, the 1617 year old rate increase to £4.00, while the Youth Development rate for 1820 year olds rises to £5.55.

But as a business and an employer, how does this affect you?

What do I need to do?

Of course, As a business, strategies should already be in place to counteract any wage increases for staff. It doesn’t matter how large or small a business is, employers are still required to pay the correct level of NMW.

And while there is no exact requirement for additional paperwork for the NMW, your accounting records should demonstrate that the new rules and regulations have been complied with should any inspection from HMRC be forthcoming.

What can go wrong?

As an employer, it’s your responsibility to familiarise yourself with the new rates of pay for any relevant workers. Failure to do so, will bring penalties and fines from the HMRC.

If, under inspection, any underpayments are discovered, HMRC can issue an enforcement notice as well as a penalty. This penalty is equivalent to twice the hourly rate of the NMW for each employee that has been underpaid, multiplied by the number of days the enforcement notice is not followed. This could also lead to a maximum fine of £20,000 because, in effect, you will have committed a criminal offence.

Any employers who simply won’t pay the new rates effective October 1st, could potentially face fines of more than £200 for every underpaid employee. Not only that, but any underpayment arrears will also have to be paid and employers could be penalised as well.

Failure to pay employees the National Minimum Wage has a financial penalty of 200% of the amount underpaid to the employee below the NMW.

Smooth transition

The increased NMW is a double edged sword, a higher level of income for workers, but an increased cost to businesses. Whatever your stance, it’s vital for businesses to ensure they know about the changes and potential penalties before they come into effect on October 1st.

While the transition should be smooth, there are potential hazards to look out for. If you’re unsure on any aspects of the new legislation, call us on 01404 41977 or email office@griffinaccountancy.co.uk and we’ll be happy to discuss them with you.